I said it! I meant it!

Yup, if you look down the side of this post, you will find ads for Pay Day Loans, for that I apologize, I need to look into Adsense on how to turn those off, but yes, Pay Day Loans are the Financial Equivalent of Crack to your finances.

I have no idea how Crack feels, and I do not wish to ever learn (I have much the same view on Pay Day Loans too), however, prevailing opinions is that Crack is highly addictive, and it?s high diminishes over time so you have to use it more but you still don?t ever reach that initial high, much like a Pay Day Loan. Pay Day Loans are highly financially addictive, and once you start using them, your financial well-being goes down hill quickly, and they are hard to kick as a habit.

Modern Day Loan Sharks

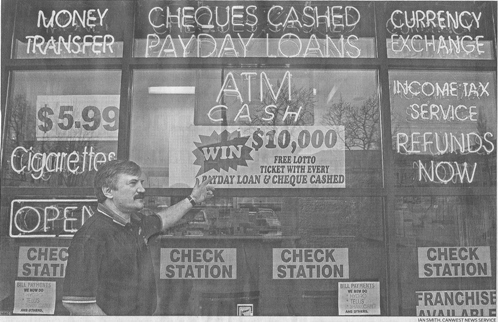

Why am I bitching about this still? Where I live in Ottawa is a relatively affluent area (although it does have a food bank), but it has more than a few Cheque Cashing/Pay Day Loan ?stores?. All I can ask is What the Hell is Going on?

Interest rates are ridiculously low and these places are spreading faster than the black death in the middle ages, what happens when interest rates start going up? There are more regulations on these places, but I just don?t understand why there are so damn many of them.

Please feel free to comment on this (any comments about how I am a hypocrite for having ads on my site for these parasites, expect a colourful reply, but take your arguments to Google for allowing them to advertise) topic, and any insight as to why they are multiplying in a Fibonacci sequence would be helpful too.

Source: http://www.canajunfinances.com/2012/09/24/pay-day-loans-the-crack-cocaine-of-personal-finances/

in plain sight hunger games movie review bats hunger games review jeff saturday jason smith jon corzine

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.